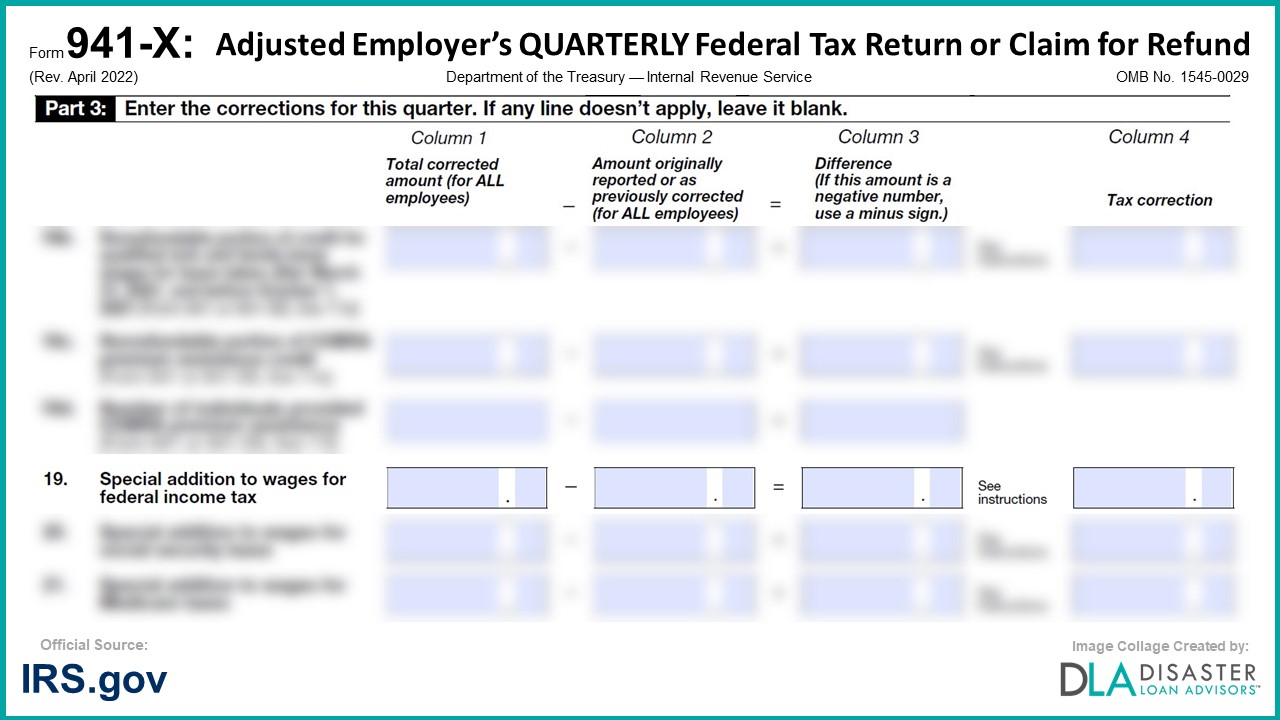

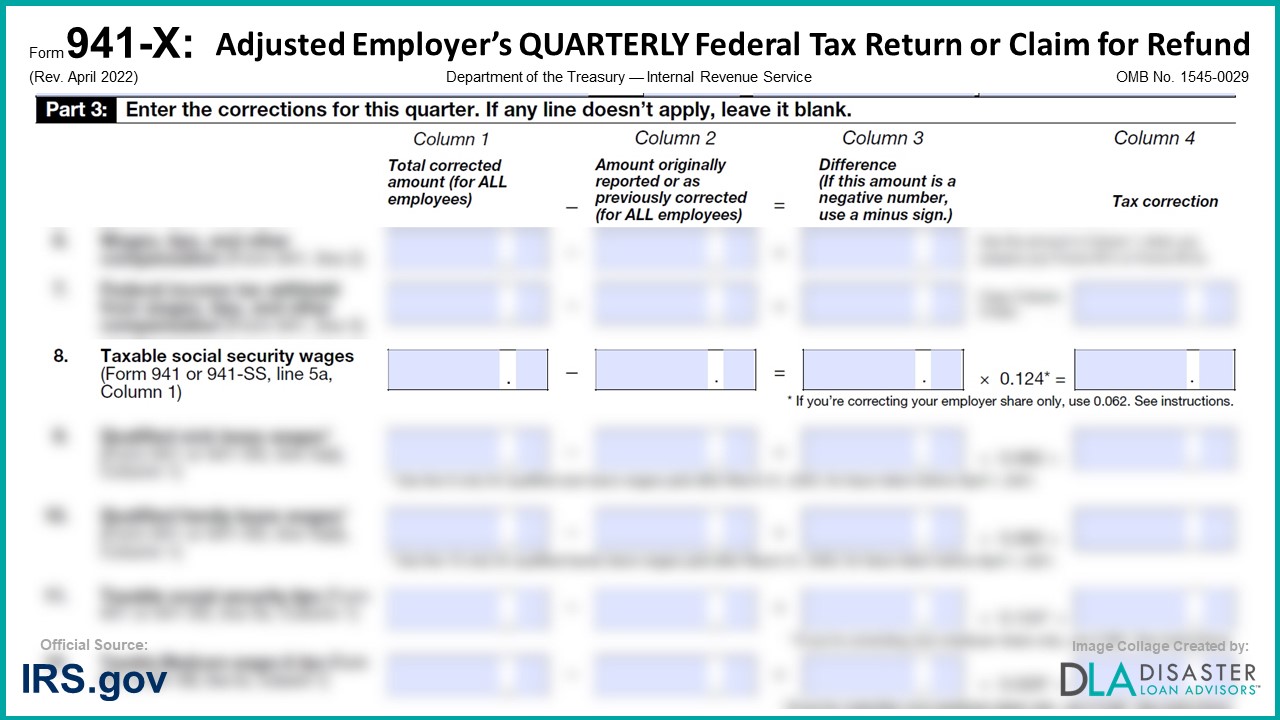

941-X: 19. Special Additions to Wages for Federal Income Tax, Social Security Taxes, Medicare Taxes, and Additional Medicare Tax, Form Instructions | DisasterLoanAdvisors.com

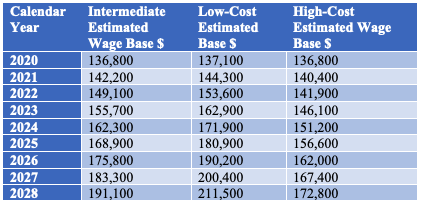

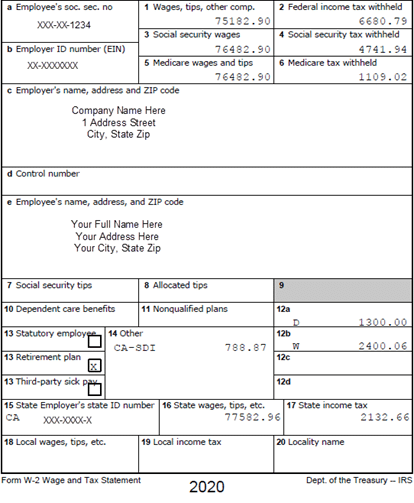

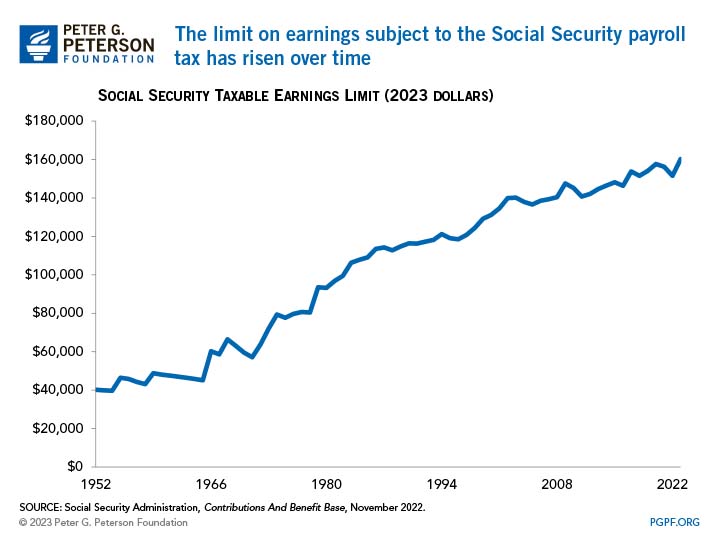

Social security wages can't exceed the social security wage limit of $113,700.00 - Microsoft Dynamics GP Forum Community Forum

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

.png?width=5000&height=3994&name=MicrosoftTeams-image%20(3).png)