Federal Withholding: Calculating an Employee's Federal Withholding by Using the Wage Bracket Method - YouTube

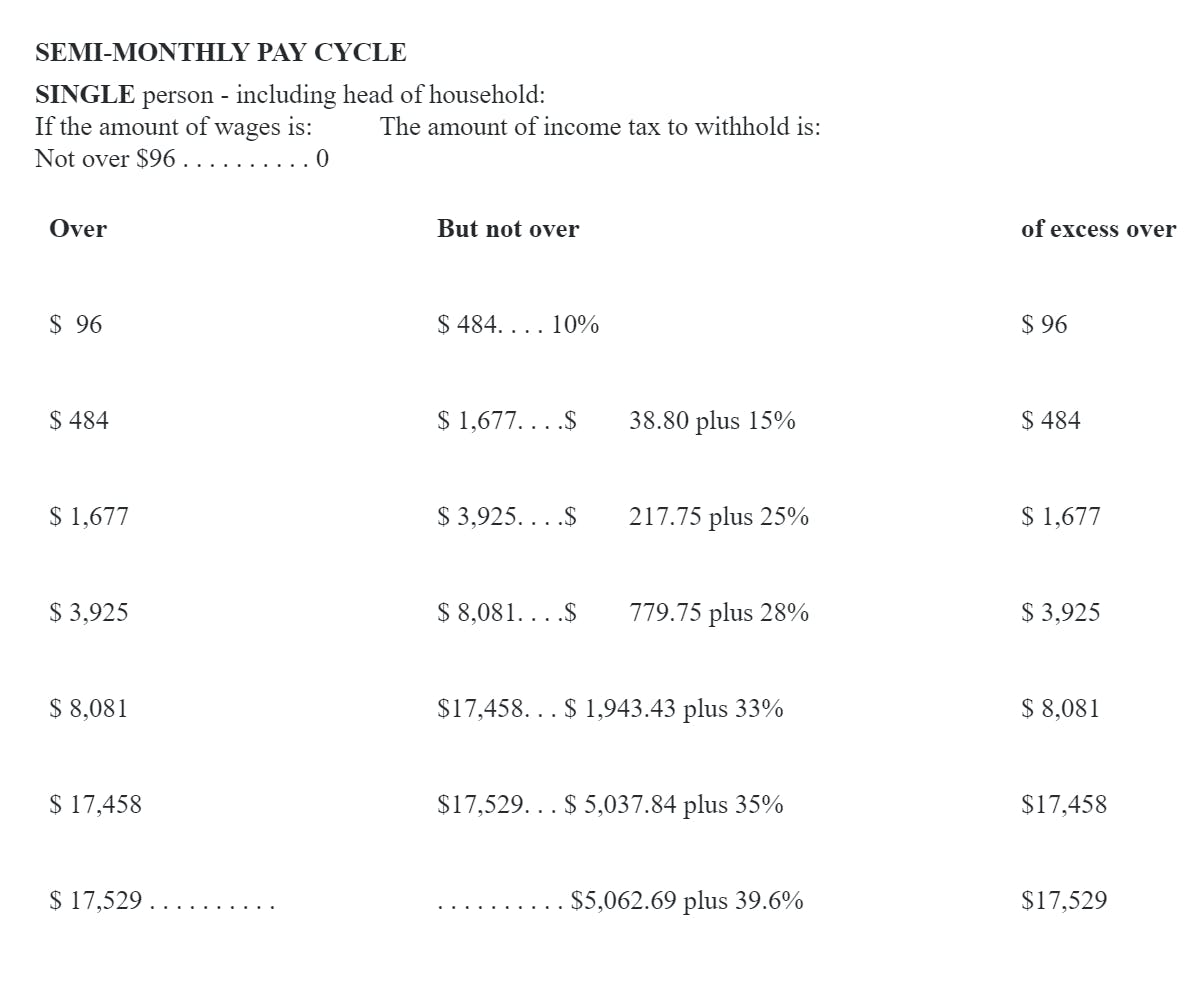

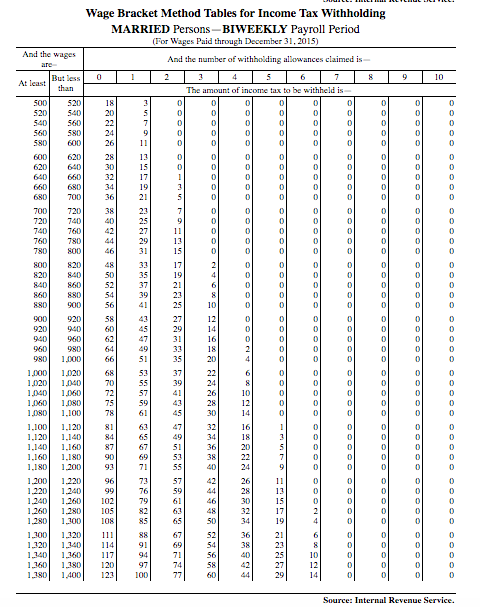

Publication 15, Circular E, Employer's Tax Guide; 16. How To Use the Income Tax Withholding and Advance Earned Income Credit (EIC) Payment Tables

:max_bytes(150000):strip_icc()/what-is-my-legal-obligation-to-pay-employees-397929-final-updated2020-a91daa5d21be4818bf0ab5eeb7a20a42.png)

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

.jpg)